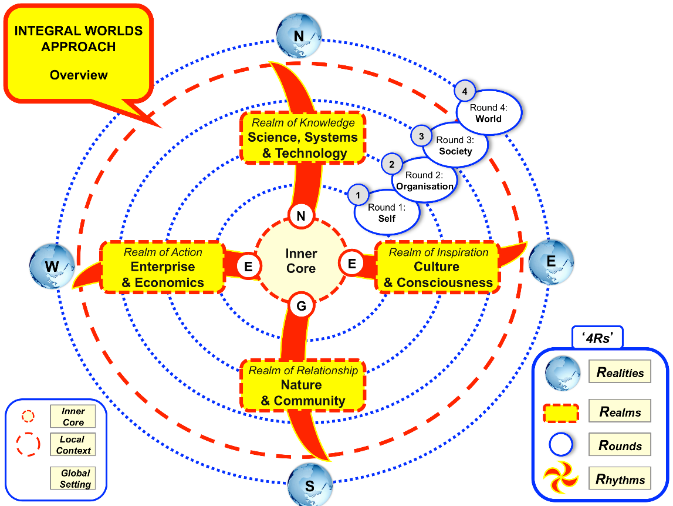

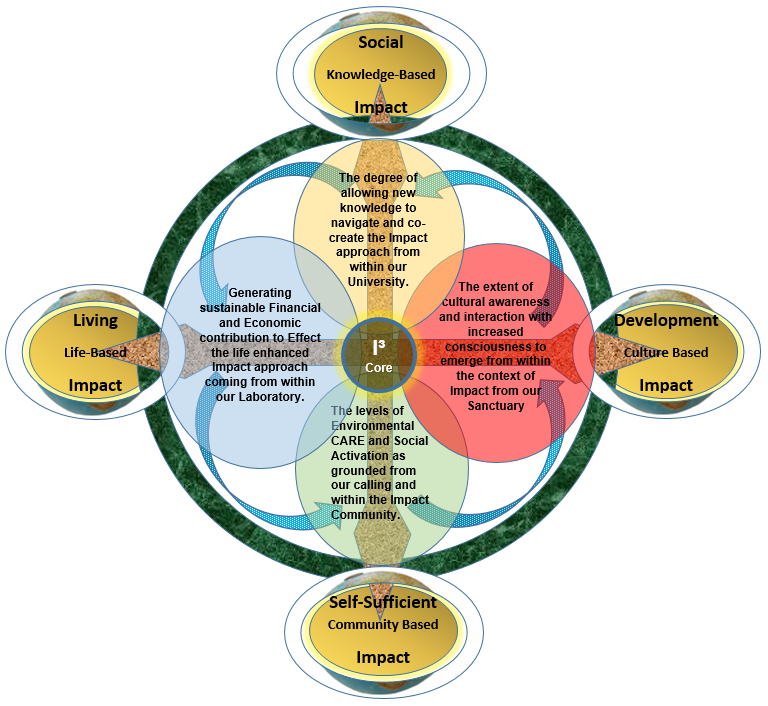

I³ is based on the Integral 4-worlds approach as developed over decades which in turn is based on millennia of human wisdom about our nature as human beings, our environment, our social understandings and how we can best effect and manifest what we want within the full spectrum of our existence.

I³ also includes the reality that all investments are in effect “Impact” and create activity, change and leaves a footprint in all areas of human and natural life, the question as always, what can you see and want to manage. One important difference and often forgotten aspect in the change dynamic and development in the investments firms themselves which I³ addresses through the design of its working methods.

The I³ approach is designed in a simple way to navigate an investor through the dimensions of Impact based on their own specific needs and requirements in combination with their values and beliefs system towards investments. This aspect is specifically important for family offices seeking to build real sustainable Impact capital through legacy and generational purpose.

Here is a short video explaining I³:

What do we offer?

For any firm who is serious and has integrity in their approach towards Impact investments, we provide an individual and developmental path to build a full spectrum approach that suits and works for them.

Any initial and potential work is always discussed and framed through an initial free consultation.

This can then be followed by a fixed cost and time-frame diagnostic assessment of the firms’ background and current Impact approach with potential gap-analysis.

Depending on needs and requirements, a more comprehensive plan may follow.

Q&A

Q: Why use I³ compared to other approaches?

A: Starting from the basic premise that all capital investments in actuality are Impact investments we need to become more “Integral” i.e. inclusive, holistic and comprehensive. We believe that I³ is the only full spectrum Impact approach today that captures the real footprint of any Impact that you may create. Importantly, I³ contain a dynamic which creates a natural and organic way for your Impact approach to become rooted in what you truly are about and develop from there. This dynamic also helps you to identify, see and work with more impact strands across any portfolio. We call it going “integral” because we use the associated 4-worlds integral methodology witch captures the full and true Impact of any investment.

Q: Why is that important?

A: Firstly, being full spectrum, I³ gives you the underlying architecture and a tool set required to construct a tailored Impact methodology robustly and as a far and deeply as you can work and see. Thereby creating an Impact blueprint which can build and reinforce on itself and therefore becomes the vehicle for you and the organisation to further develop your Impact. Secondly, the integral dynamic creates the necessary interaction between the component parts enabling you over time to naturally evolve your impact approach exactly as you see fit.

Q: Why can’t I do this anyway as a continuation with what we currently do?

A: You could of course. However, Impact investments are different to conventional investments in that they need to make more visible the values and beliefs that you represent and wish to become operational across all impact dimensions. This of course depends on the type of capital you manage and the need for ongoing development of people working with its Impact. I³ is designed to capture, link and deepen these as you progress so you continuously strengthen and develop your overall strategic Impact approach.

Q: Is that not trying to over complicate things?

A: When you enter new territory, with each new context, you need a comprehensive road map which given you sufficient detail to enable you to navigate the terrain whilst not being overly complex, allowing you to explore, evaluate and experience the Impact journey to truly create the Impact and understanding you intended. If a map lacks sufficient detail, logic and ease of use, not only risk to cause confusion, it may get you lost on the way jeopardising you not reaching your intended destination. Also, if you get lost, you are unable to really capture much of the Impact on the way so you lose intentionality and risk your Impact outcomes.

I³ captures only what you can and want to include on the journey. It’s a “Take what you like and leave the rest” way of capturing Impact. However, it highlights what you may have missed and ask you the question whether it should be included. This is important if we are to build our Impact knowledge, intention and outcomes strategically.

Q: Am I not then “locked in” into some complex, rigid and expensive technology?

A: No. Built on purely natural and existing organic ways of operating, I³ will not be in conflict with any methodology you may already have in place. It can only help to take it to the next level if you so wish and desire. Also, I³ has been designed as a totally open source technology and as it’s free at the point of engagement, it’s up to you how and to what degree you want to implement it.

Q: How does this help my investments?

A: Whilst our Impact can be thematic and highly directed, our real Impact is often a function of how our investees create Impact based on the level influence we have. In collaboration with the investee, I³ co-creates the necessary framework on which to hang the agreed Impact objectives which would help to highlight gaps to strengthen the investees’ strategic business outcomes and which aligns with our total Impact returns.

Q: What would it mean for the people involved?

A: It would create more engagement with what is important for you and the firm. Help strengthen your purpose of the organisation and continuously help clarify Impact goals and targets. If you use I³ you cannot not help people to grow and develop themselves in the process. This is particularly important in firms where the distance between capital and its Impact awareness is short and people would benefit with working more closely with real Impact e.g. in a family office or a highly impact oriented investment manager.

Q: How do I find out if or any parts of this approach can work for us?

A: This is not a “one fits all” approach so we would suggest an initial orientation meeting where we discuss your current Impact approach and where you think you would like to be in the future. We also discuss the people involved and some of the challenges that you may have in adopting and managing Impact across the organisation or family which I³ could help solving.

Q: What will this cost us?

A: Nothing apart for any possible direct cost that you may require us to incur. I³ was developed to be free to use so we are happy to explore ways of co-creating and collaborating on its use within your firm without any obligations. We have truly a “take what you like and leave the rest” way of working as our intention is only to create change and Impact development when it’s really wanted and needed.